By Nicki Bourlioufas

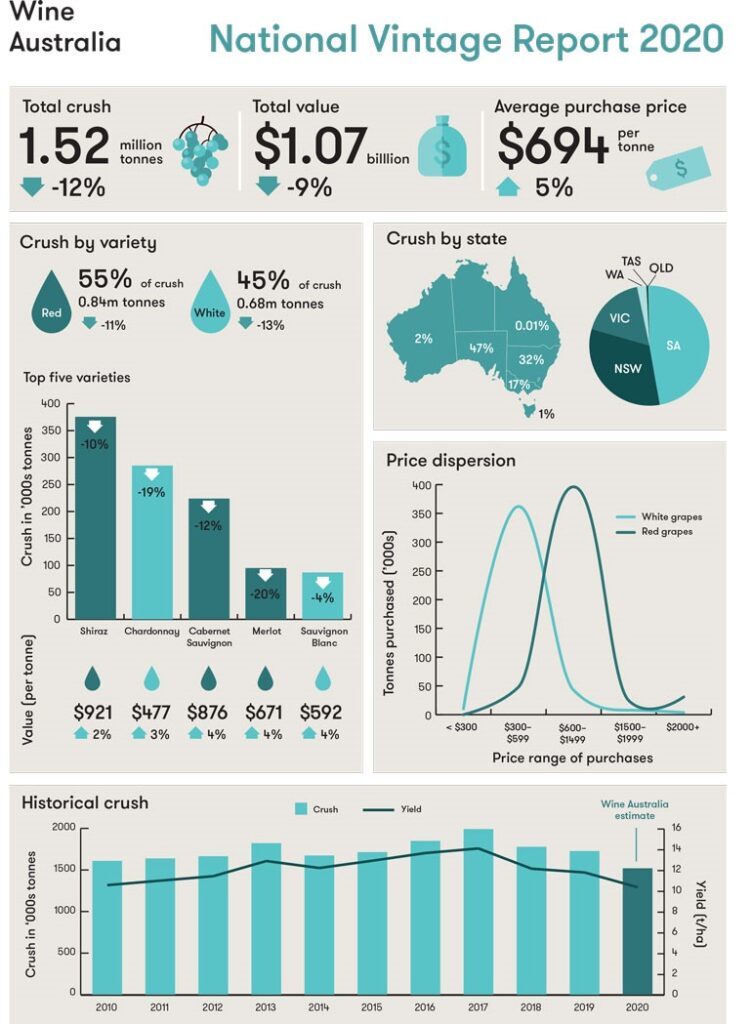

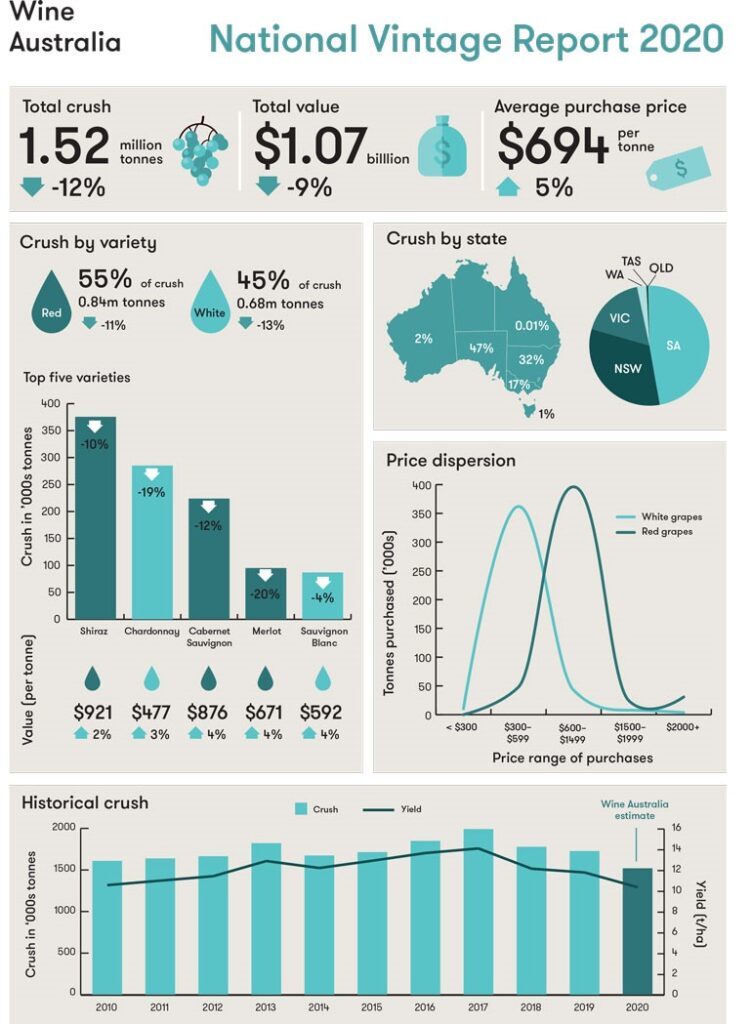

The Australian winegrape crush in 2020 was 1.52 million tonnes – the lowest since 2007 given the impact of drought and bushfires, according to the National Vintage Report 2020 from Wine Australia.

The 2020 crush was 12 per cent lower than the 2019 crush, and 13 per cent below the ten-year average of 1.75 million tonnes. While the crop was the smallest since 2007, it will equate to and over 1 billion litres of wine. It quality is expected to be high and similar to the 2010 yield, when the crush was 1.61 million tonnes.

Wine Australia Chief Executive Officer Andreas Clark said autumn temperatures were generally around average or slightly cooler, leading to ideal ripening and harvesting conditions. The reduced yields will deliver more concentrated fruit colours and flavours.

“This vintage will enable us to continue to meet our targets of value growth in premium wine market segments, although the constrained supply will restrict overall volume growth in the next 12 to 24 months,” Clark said.

Strong demand for Australian wine is reflected in the 5% rise in the average value of grapes, of $694 per tonne compared with $663 in 2019, and having increased by a compound average of 5% for the past six years. The total value of the winegrape crush is estimated to be $1.07 billion.

Drought, fires hit crop

Crop losses due to fire and/or smoke damage were reported in around one-quarter of Australia’s winegrowing regions; however, the overall reduction due to direct damage or smoke effects was estimated (based on winemakers’ estimates) to be less than 40,000 tonnes, or 3% of the total crush.

Red varieties fared better than white varieties in 2020, being down by 11% compared with 2019, while white varieties were down by 13%. Australia’s largest variety, Shiraz, fell by 10% to 376,000 tonnes and increased its share of the total crush to 25%. Other red varieties to do relatively well were Durif and Ruby Cabernet (up by 9% and 8% respectively) while the biggest declines were for Pinot Noir (down 24%) and Merlot (down 20%).

“The increase in average value for Shiraz is far outpacing that for Chardonnay, leading to strong demand signals favouring Shiraz. This is reflected in our exports. The average value of bottled Shiraz exports was $9.21 per litre FOB in 2019 compared with $4.29 for Chardonnay,” said Clark.

The main contributor to the reduction in the white crush was Chardonnay, which was down 19% to 285,000 tonnes, while Riesling had the biggest drop of 28% to a 20-year low of just under 17,000 tonnes. Prosecco increased slightly, against the general trend, and moved up to ninth place in the top 10

Source: Wine Australia