By Nicki Bourlioufas

While other industries have suffered dramatically, the US wine industry has held relatively steady during the COVID-19 pandemic, with volumes consumed forecast to be steady this year from 2019, though revenue is expected to fall, according to a new report from Wine Intelligence.

According to the research organisation, key wine consumer trends during the COVID-19 era have included the following:

- Growth in wine consumption frequency

- Non-food occasions driving wine growth

- Slow recovery in average bottle spend on wine in off-premise

- E-commerce gains in popularity

- Shift to local wines

“Clearly there has been a huge shift from on-premise to off-premise, but in most markets, this has more or less cancelled each other out,” said researcher Richard Halstead in a recent report, Wine’s Rollercoaster in the US 2020.

The latest modelling from Wine Intelligence, based on consumer usage and attitude data collected in August 2020, suggests that total wine consumption in the US will show static volumes for 2020, with consumers broadly drinking the same amount of wine.

“But inevitably, [they are] drinking proportionally more at home versus in the on-premise. What has changed is the level of uncertainty because of these factors, coinciding with the crucial fourth quarter of the year when wine (and alcohol generally) benefits from the holiday season surge,” said Halstead.

The US market is the number one market by volume and value in the world and despite having one of the worst experiences with Covid-19 in 2020, “US wine sales overall have remained strong,” he said.

However, while volumes might be stable, a ‘significant’ value decline in the US market is expected for this year.

The biggest winners of the post-COVID wine market in the US are bigger brands and domestic brands.

“Both have good exposure in mainstream off-premise, and – as with other markets, such as Australia, domestic producers have benefited from a surge of ‘buy local’ instincts from consumers. If this negative scenario occurs, coupled with the impact of tariffs on certain European wines (unless quickly repealed by a new administration), 2021 may prove to be a tough year for wine producers exporting into the US,” said Halstead.

Within Australia, wine drinkers have increased their purchase levels of domestic wines at the expense of imports.

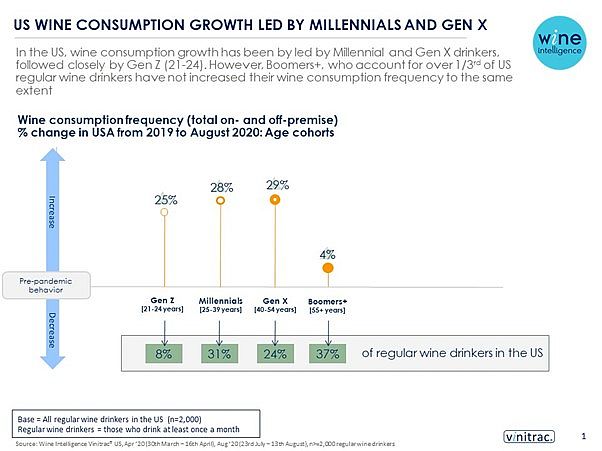

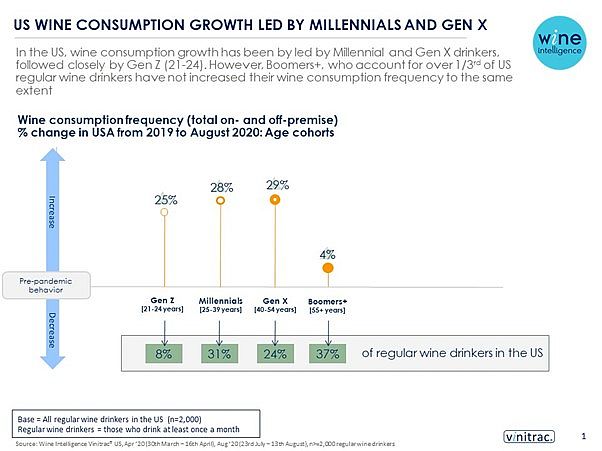

In the US, wine consumption growth has been led by millennials and Gen X drinkers, followed closely by Gen Z (those aged 21-24 years). Baby Boomers+, who account for over one third of regular US wine drinkers have not increased their wine consumption frequency as much.