By Nicki Bourlioufas

A battle between Australia’s largest supermarket and liquor retailer Woolworths and France’s LVMH, which led to supply shortages of the world’s famous Champagnes Moët & Chandon and Veuve Clicquot at its stores, has been settled, with Woolworths putting LVMH liquor products back on its shelves.

Supply problems reportedly began in February when Dan Murphy’s refused price increases demanded by LVMH on some of its key champagne and other liquor brands, according to a report in The Australian newspaper.

Tell us here whether you drink sparkling wine and whether you prefer Champagne or Prosecco.

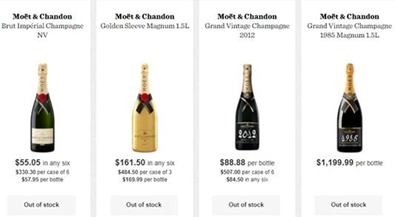

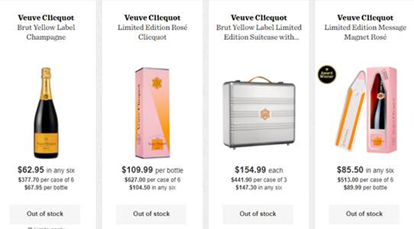

Dan Murphy’s ran out of stock of the LVMH Champagne wines and other LVMH liquor products, which couldn’t be bought online (as at 22 September) and were still unavailable in some stores at the time of writing on 23 September.

An Endeavour Group spokesperson, the parent company of Dan Murphy’s and BWS, said supplies of Moet were now being restocked in BWS and Dan Murphy’s stores, both owned by Woolworths. She couldn’t comment on how the price dispute was settled.

“Products from the supplier are currently being distributed through our store networks, and most BWS and Dan Murphy’s stores now have the products on shelves. We would like to thank our customers for their patience,” the spokesperson said.

“We don’t make public comment on our commercial dealings with suppliers.”

Long time between drinks

However, some consumers could still be kept waiting. In Sydney, some stories still did not have Veuve Clicquot and/or Moet & Chandon as at 23 September, while others had stock, according to calls made to Dan Murphy’s customer call centre. An online shopping inquiry had indicated the brand was still out of stock at some Dan Murphy’s stores as at 22 September 2020.

Moët commands about 40 per cent market share of the Australian champagne market, and Veuve Clicquot has a share of more than 15 per cent, according The Australian. Other brands affected included LVMH’s Krug, Dom Perignon, Cloudy Bay wine, Cape Mentelle and Glenmorangie whisky.

Some Australian consumers were sympathetic to LVMH, despite its huge size, while others applauded Dan Murphy’s for taking on the French giant.

“Australians and retailers accept and understand suppliers are entitled to market and maintain margins; it is called an open market that pits one supplier against another and where the consumer makes the decision on price, not the retailer … Good on LVMH,” one reader commented on The Australian’s website.

Another said: “Standard operating procedure for Dan Murphy’s, leave no margin on the table for the manufacturer.”

However, other consumers were happy to shop for alternative brands.

“Ended up buying Mumm instead which was much cheaper and tasted just as good as Moet!” Same with Hennessy, I have switched to Martell and it’s just as good,” one comment on The Australian’s website said.

Said another: “If the dispute means that Australian consumers will not suffer a price increase then I am very happy to wait for quite a while, and go to alternatives in the meantime.”

Moët & Chandon has recently claimed the title of the world’s most valuable champagne & wine brand in Brand Finance’s inaugural 2020 ranking, with a reported brand value of US$1.4 billion.

Liquor sales booming

The pricing battle comes at a time when sales of alcoholic beverages are booming in Australia, and one of the few areas of growth in household spending during the COVID-19 pandemic, as previously reported by World Wine, Oz alcohol sales soar – but few admit to drinking more.

The alcoholic beverages category of household spending was second biggest contributor to growth in total household spending (accounting for around two-thirds Australia’s GDP) over the year to June 30.

Official data from the Australian Bureau of Statistics (ABS) shows household spending on alcohol jumped 17.4% over the year to June 30, 2020 and 13.0% in the June quarter – more than any other category listed for both time periods. Those increases came as total Australian household spending fell by 12.7% over the year and 12.1% during the quarter.