By Nicki Bourlioufas

Australian wine exports fell to a five-year low of $2.3 billion with wine exports to China plunging 77% over the year to September 30, 2021, after steep tariffs were imposed on Australian wine in late 2020. But exports bounced in Hong Kong by 135% while the UK and the US overtook China as Australia’s biggest wine export markets.

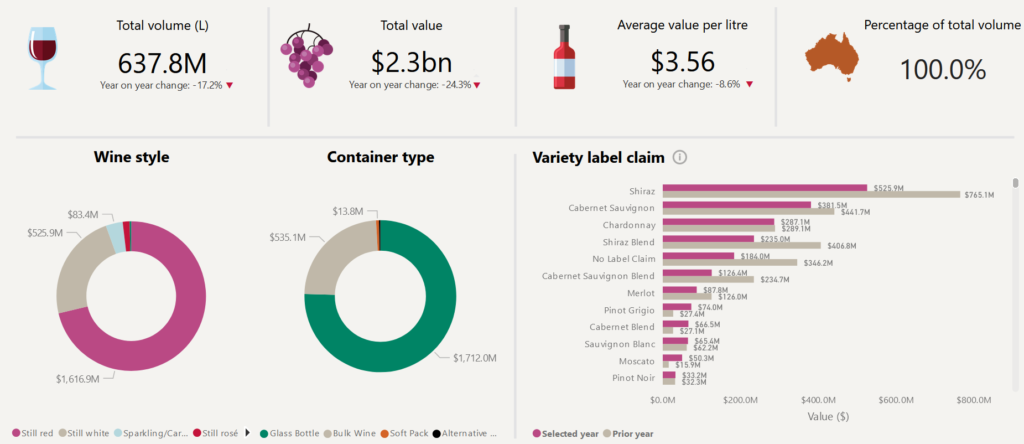

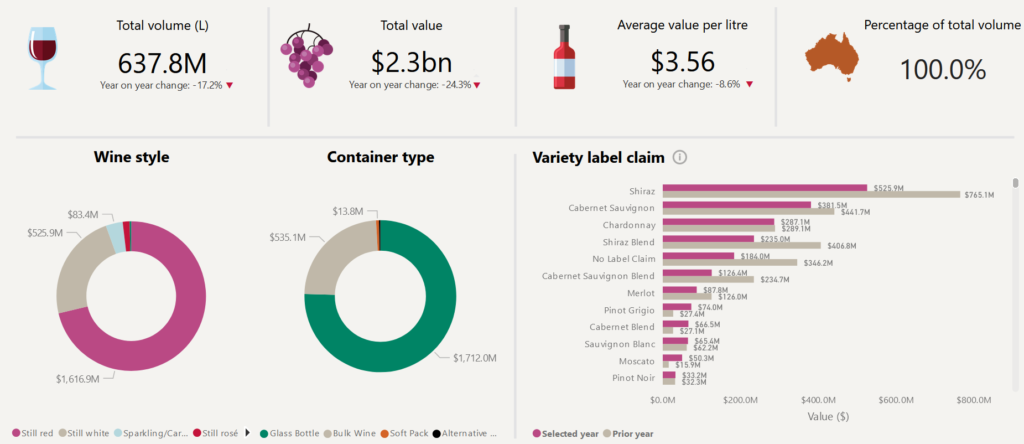

According to data from Wine Australia, overall exports for the 12 months ended September 30, 2021, dropped by 24% to $2.3 billion, with sales to China tumbling by 77 per cent to $274 million. The number of exporters shipping wine to China dropped to 750 in the year ended September 2021 from 2241 in the year-earlier period.

Some good news was that exports to Hong Kong jumped 135% to $207 million. The mainland Chinese duties do not apply to Australian wine exports to Hong Kong, which has an independent tax system from China. The former British colony could become a back-door entry for wine into the mainland, Bloomberg reports.

There was also an increase in exports to the United Kingdom (UK) and the United States (US) in late 2020 due to the COVID-19-related surge in off-trade sales, where most Australian wine is sold, when the on-trade sector was shut-down due to lockdowns and social restrictions.

Treasury Wine Estates, the owner of Australia’s most famous wine brands, Penfolds, Lindemans and Wolf Blass, was Australia’s biggest exporter of wine to China and was hit with a tariff of 175.6%. The company said in August that earnings from its business there had dropped by 77% . Treasury Wines has stepped up exports to other Asian countries such as Malaysia, Vietnam and Thailand. It had also designated Penfolds wine stored in countries such as the United States and France as part of a multi-country strategy, the Australian Financial Review reported.

This new Export Dashboard from Wine Australia provides interactive and comprehensive data and insights on Australian wine exports and production. The Export dashboard provides insights on Australian wine exports back to 2010. The data for the year ended September 30, 2021, provides a sombre picture of the impact of the Covid-19 pandemic and the impact of wine tariffs imposed on Australian wine by China, Australia’s largest export market.

Exports remain dominated by Shiraz, Cabernet Sauvignon and Chardonnay, as French varietals remain the dominant grapes grown in the nation despite talk of ‘alternative’ varietals gaining ground.

No end to tariff pain

The Australian wine market has been hit hard by the imposition of tariffs on its wine and selected producers. The chart below shows the exports plummeted 45% from the 12 months ending 30th of June 2020. On 26 March 2021, China announced final decisions on its anti-dumping (AD) and countervailing duty (CVD) investigations into wine from Australia. The AD duties – in the range of 116.2% to 218.4%, with the rate varying by supplying company – will apply to wine in containers of 2 litres or less, excluding sparkling wine for five years from 28 March 2021.

Read here for more details on government projections of the expected impact of the tariffs.

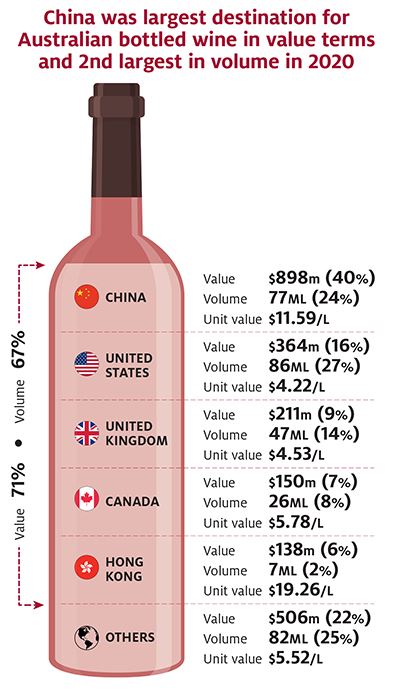

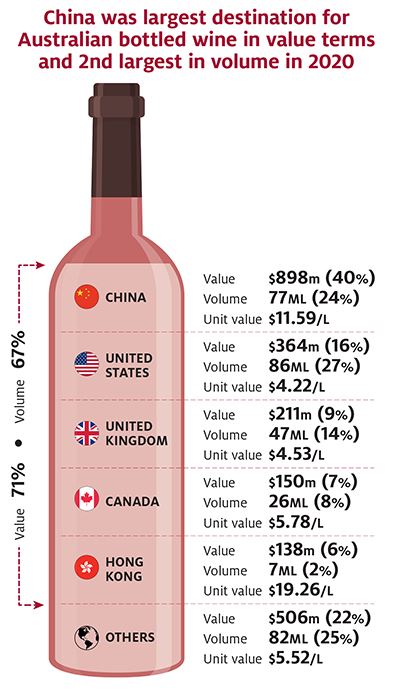

Australia exports wine to over 100 markets, but in 2020 the top 5 markets (Canada, China, Hong Kong, the UK and the US) accounted for 75% of total wine export volume and 77% of export revenue. China was the largest in value terms, accounting for 33% of export revenue and ranking third in volume (after United Kingdom and United States) at 13%. However, for bottled wines specifically, China was Australia’s largest market in value and 2nd largest in volume, with 40% of the export value share and 24% of the export volume share.

In the medium term, altered production decisions and diversion to other markets will lessen the impact of China’s duties. But modelling from the Australian government shows the gross value of wine production in 2025 also being $480 million lower than would otherwise be the case without China’s AD duties, due to reduced production combined with a lower expected average price. This would result in a loss of around $67 million to wine grape growers, equivalent to a 6.7% loss of the gross value of production of wine grapes.

Another potential future market for Australian wine in Asia is India, where wine is a relatively new and unknown beverage but showing potential. However, all countries currently face a 150 per import tariff on wine exported to India, which is a significant deterrent for consumers, according to this report from Wine Australia.

Another is South Korea. According to Wine Intelligence, South Korea in 2021 is the second most attractive wine market in the world, following the US, a significant up-shift from the tenth position it held in 2019. The South Korean wine market was valued at US$895 million in 2019. While the market size is relatively small , the only countries that recorded stronger growth rates over the last five years were Russia, India and the United Arab Emirates. Growth in volume has been seen across all major wine export countries to South Korea, and the value per bottle of still and sparkling wines has also seen an increase.

According to the Global Compass 2021 Report, an annual study that measures key economic and wine market factors to rank wine’s attractiveness in 50 focus countries, the US’s strong economic rebound, partly funded by government stimulus, kept it ahead, said Lulie Halstead, CEO at Wine Intelligence. “However, #2 South Korea is gaining fast in our model. Wine growth in the US is tailing off, whereas still wine volume in South Korea grew by more than +11% CAGR 2016-2020, according to IWSR Drinks Market Analysis,” she said.

The National Vintage Survey dashboard is a one-stop data-shop for Australia’s vintage crush data from 2015 to the latest report. This dashboard provides vintage crush figures by volume and value, detailed tables on crush by variety and region, as well as average weighbridge purchase value by variety and region including price dispersion. All data can be downloaded in Excel form, while the dashboard can also be downloaded to PDF.

The data comes from the National Vintage Survey, which is the annual winegrape crush and weighbridge price survey conducted by Wine Australia on behalf of the Australian wine sector.