By Nicki Bourlioufas

Australian wineries boosted online sales by 50% in the 2019-20 financial year, and sold more wine directly to the consumers, helping to offset on-premise drops and survive COVID-19, according to a survey released by Wine Australia.

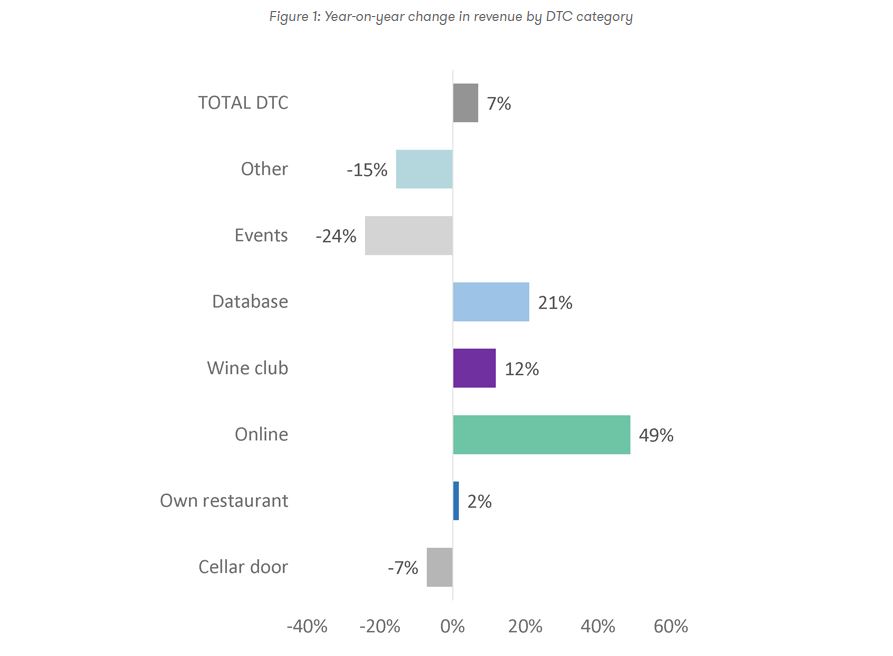

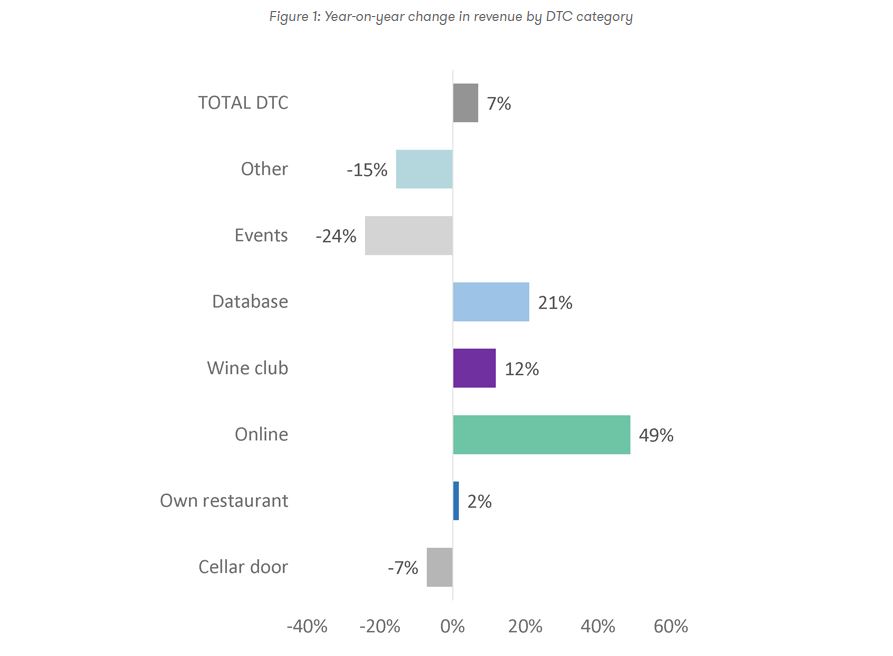

The results of Wine Australia’s Wine Direct-to-Consumer survey 2020, published today, show that online sales jumped 49% over the year to June 30, 2020, while direct-to-consumer revenue grew 7% in value in 2019–20 compared with the previous year. Overall, survey respondents had a small reduction in total revenue (down 3%), consistent with export data indicating a decline of 1% in export value, given significant falls in on-premise sales due to pandemic-related lockdowns and restrictions.

The strong growth in online sales is consistent with anecdotal feedback from wineries as well as consumer research showing a strong shift to online purchases as a result of the pandemic restrictions. However, the off-trade channel grew by 6% in retail value, but it is not known how much of this translated to increased income for wine businesses, Wine Australia said.

Cellar doors adapt to COVID

Wineries reported having made a number of changes in response to COVID-19, aside from complying with government-regulated requirements on hygiene, signage and social distancing. Most common was that wineries adopting seated tastings only and taking bookings for tastings. “These changes appear to have had a positive effect on revenue, as reflected in the increase in average case value,” Wine Australia said, noting that the average value per case sold at cellar door rose 5% to $241 per 9-litre case.

Average cellar door visitor numbers in 2019–20 fell 23% to 12,000 compared to approximately 15,000 in 2018–19. The decline was all in the second half of the financial year (first six months of 2020), which was down by 47% compared the same period in the previous year.

Liquor sales up overall in Australia

One in two Chinese wine drinkers and almost one in three Australians buy their wine online, followed by 25% in the US, according to new research from Wine Intelligence, with the level of internet shopping boosted by COVID-19.

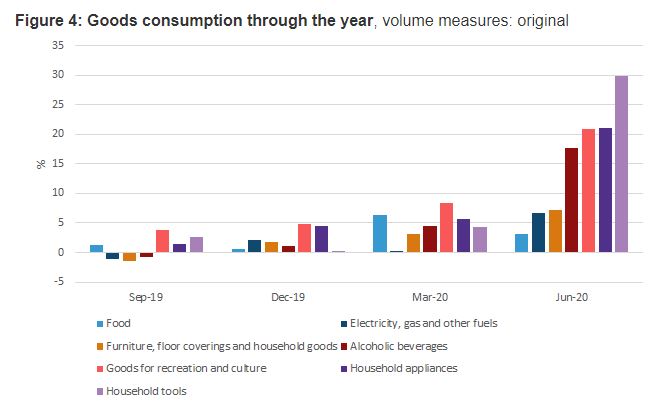

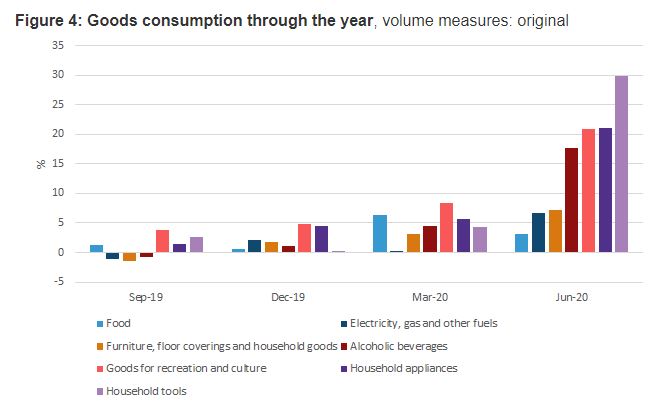

Propped up by online sales, official data from the Australian Bureau of Statistics shows alcohol sales are soaring and propping up economic activity at a time when spending is falling on many other goods. The alcoholic beverages category of household spending was one of the biggest contributors to growth in total household spending (accounting for around two-thirds Australia’s GDP) over the year to June 30, as the chart below shows.