By Nicki Bourlioufas

If you’ve walked into wine retailers in Australia lately you may have noticed that cans of wine are increasingly making an appearance on shelves. While Australians prefer their wine in a glass, wine in a can is gaining in popularity.

Irene Stocks, Sales & Marketing Director of Barokes, inventor of the Vinsafe canned wine technology, says in the past five years, its wine can business has grown significantly with the accreditation of a number of filling facilities based in Australia and New Zealand capable of filling to Vinsafe specifications.

“This has seen a boom in the number of Vinsafe products produced and launched into domestic and export markets, including large wine producers such as Pernod Ricard, Constellation Brands, Brown Brothers, to name a few. These well-known brands in a can and a broad range of wine varieties has seen a massive growth in canned wines available in retail and online in Australia,” says Stokes.

However, across the nation, glass is still preferred as a wine container, a report by UK research firm Wine Intelligence reveals. Most Australians don’t like their wine in a can. Beer, for sure, but not their Pinot Noir, Sauvignon Blanc or any other varietal.

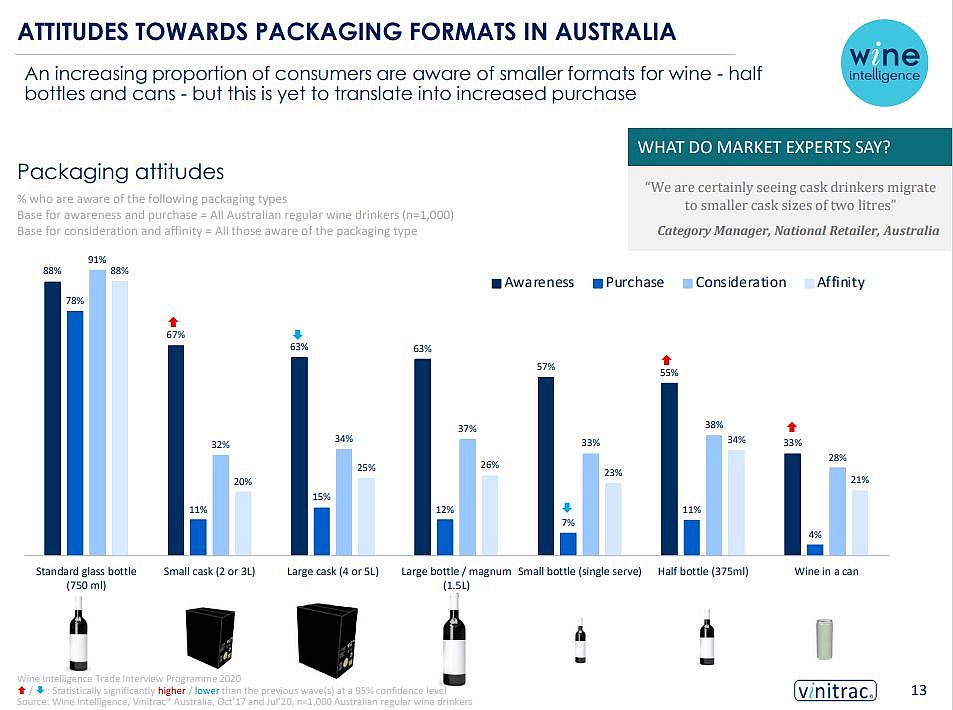

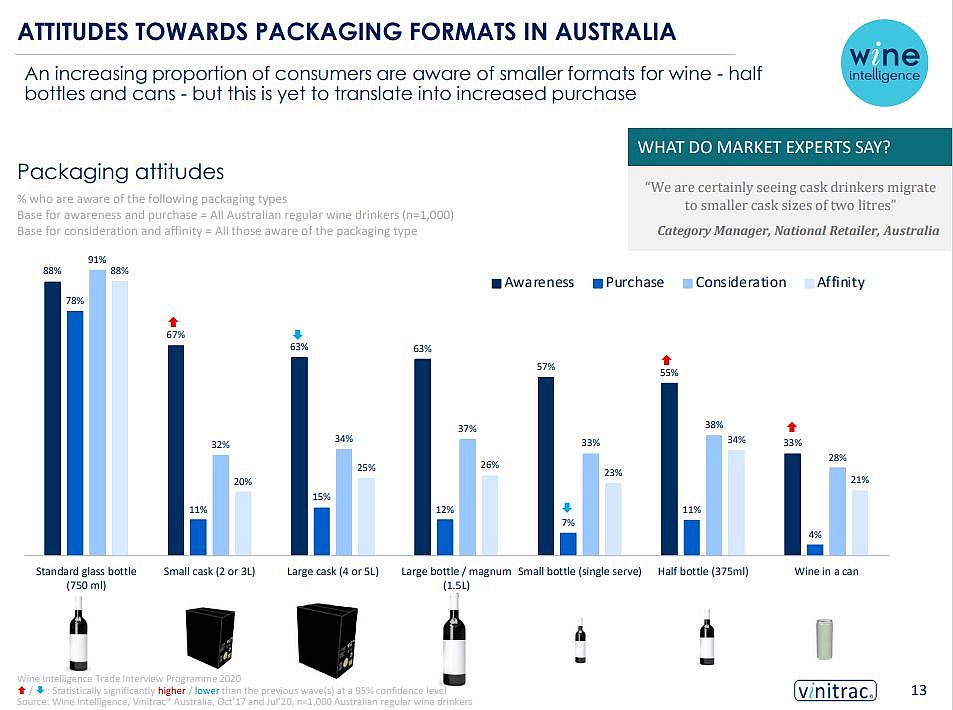

Wine Intelligence’s latest research into wine packaging formats in the Australian market shows while awareness of wine in cans is rising, the conversion-to-purchase rate over the past three years has declined, indicating growing awareness is not translating to purchase at the same rate.

“The main barrier to purchasing alternative packaging format is the underlying preference for standard glass bottles, with these being even more dominant in Australia than in other comparable established markets,” the report says.

“Smaller format bottles continue to be seen as delivering comparatively poor value for money, whilst magnums are seen as less practical and portable,” the report finds.

Views from the market

According to Stokes, it was not until Vinsafe was created in 2002 that it was even possible to successfully can wine, and maintain its integrity (sight, aroma and taste), shelf-life stability and can lining integrity.

“Now, accredited can suppliers guarantee Vinsafe cans for 12 months, which is six to nine months more than non-Vinsafe cans,” says Stokes.

“Additionally, Barokes wines have been awarded in excess of 400 medals at international wine competitions, including numerous trophies, platinum, best in class, gold etc medals, with many of these awarded to wines canned four to five years earlier. This is an extraordinary achievement and makes it very clear that Vinsafe is the only globally market and time-proven solution for consistent quality canned wine production,” says Stokes.

According to Wine Intelligence, the following are views of others in the Australian wine industry.

“The US was at the forefront of the wine in a can category and we jumped on that really early and tried to pioneer it here. Over the past two years, it seems to be growing steadily but it is not setting the world on fire. I think it will continue to be a slow burn,” said a wine manager at a national Australian retailer.

“There is growth for cans but still from a small base. I think what has had good growth over the past 12 months is smaller format bottles. People are managing their consumption or moderating with formats smaller than 750ml,” said a wine marketing manager with an Australian producer.

Yet wine marketing experts still predict that there are opportunities for smaller formats to support increasing moves to alcohol moderation and consumer demand for single serve to increase choice of products.

According to Wine Spectator, the canned wine category has seen major growth particularly in North America where sales of canned wine has gone from $2million in 2012 to $183.6 million by July 20201.

In contrast to cans, casks continue to perform well in the Australian market, with a significant increase in awareness of smaller casks since 2017. However, casks of all sizes remain primarily associated with value for money and lower quality wine – a legacy they are yet to move away from.

In terms of which types of consumers are leading the opportunity for alternative formats for wine in Australia, awareness of these options is significantly higher amongst older ‘Boomer’ consumers – but these are not necessarily the right audience. For wine in cans, awareness is actually significantly higher amongst 40-55 year olds rather than amongst younger Gen Z and Millennial consumers. However, despite having generally lower awareness of alternative wine packaging formats, purchase of these formats is higher amongst younger drinkers, once they become aware of the options available.