Wine has become a more central part of many consumers’ lives over the past 12 months. For some, it is a habit restored; for others, it is a legacy of lockdown. But research house Wine Intelligence warns that while glasses will continue to be filled in 2021, governments may boost taxes to help cover the costs of COVID-19.

“On the whole, we see a mixed picture for wine in 2021,” says Richard Halstead, chief operating officer, in a blog, Wine Intelligence’s Industry Predictions for 2021.

“Economically, there will be hard times in many consumption markets, as countries take stock of the damage to government finances and the wider economy and tax rates rise to start to pay for yawning fiscal deficits,” he says.

“More activities will become possible, including travel and eating out, and those in the tourism industries and the on-premise with the financial strength and smarts to remain solvent will have a great second half of 2021 as pent-up demand is released onto a smaller base of outlets.”

But even as lockdowns persist in the first half, Halstead expects people to keep drinking up – either the result of new habits or ones entrenched during lockdowns.

“For some, it is a case of a habit restored; in others, it will be a new legacy of lockdown. In both cases, we think the habit of drinking, and caring, about wine, will persist for some time, or at least until our lives become so busy and crowded with other interests again.”

Economically, Halstead says there will be hard times in many countries, and some could increase wine taxes to start to pay for huge fiscal deficits, which could weigh on demand for wine, along with uncertainty about future job prospects. “Governments around the world will be actively looking for ways to plug the frightening gaps in their finances built up by the pandemic, and ‘sin taxes’ will be an easy target,” says Halstead. However, rising prices will be mitigated by excess wine stock evident in several countries.

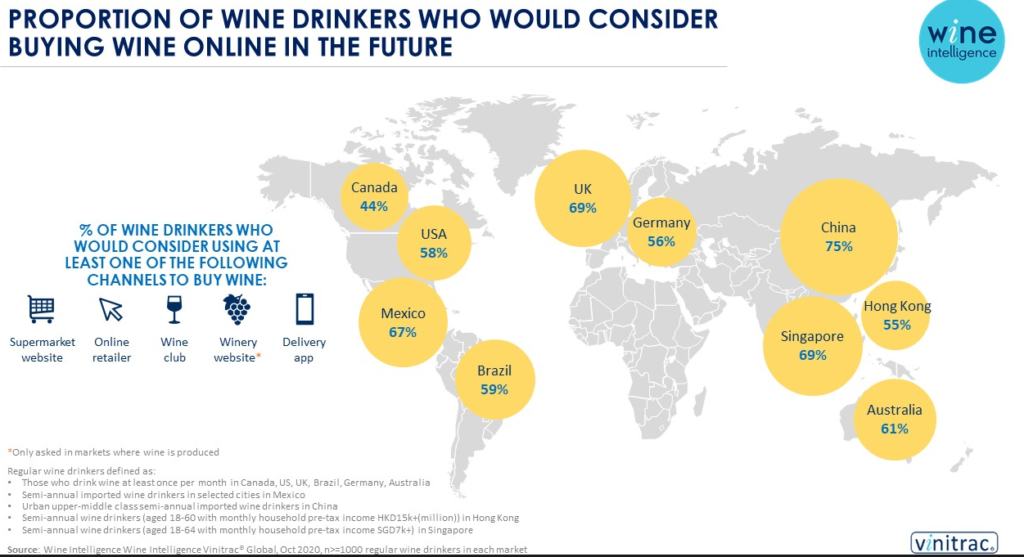

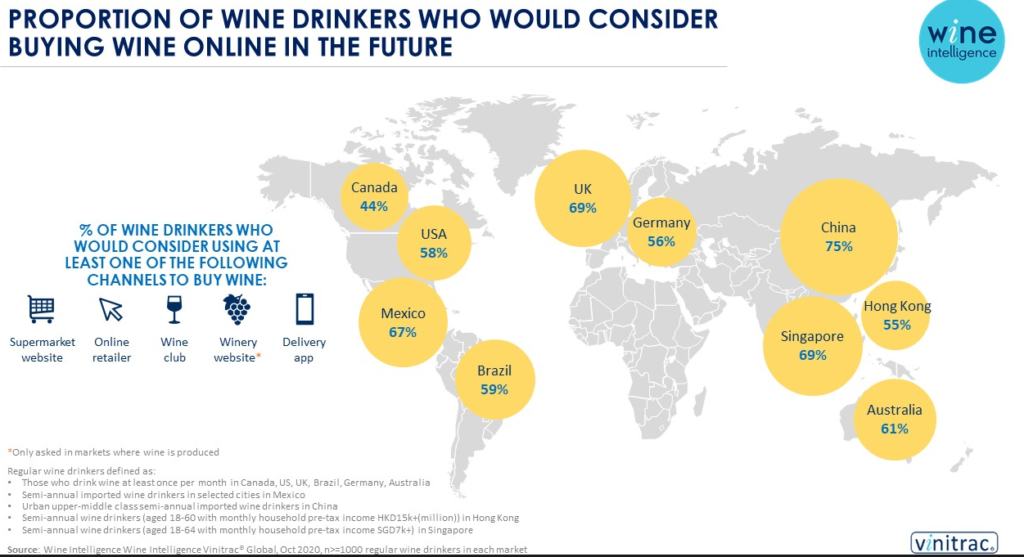

Halstead also expects the e-commerce boom will continue. The surge in online wine sales evident in several countries in 2020 will be supported this year by significant investment and consolidation.

“The key offer for 2021 will not be range or pricing so much as immediacy: the traditional e-commerce model of order today, get it sometime next week, will be overtaken by operators who can fulfill today’s orders today,” says Halstead. Online buying rates are highest in China, with the UK also high, a scenario expected to persist in 2021 with ongoing lockdowns and high COVID infection rates exacerbating the trend.

As for wine format, the bottle will remain the container of choice for producers and consumers, “though 2020 was an unexpectedly good year for the bag-in-box format, as bulk purchase lent itself particularly well to the zeitgeist of pantry-filling and at-home drinking.

“Paradoxically, it was also a good year for wine in cans, which, in an ad-hoc 2020 where social plans could materialise and evaporate at a moment’s notice, offered the three Ps: portability, portion control and preservation,” said Halstead.