By Nicki Bourlioufas

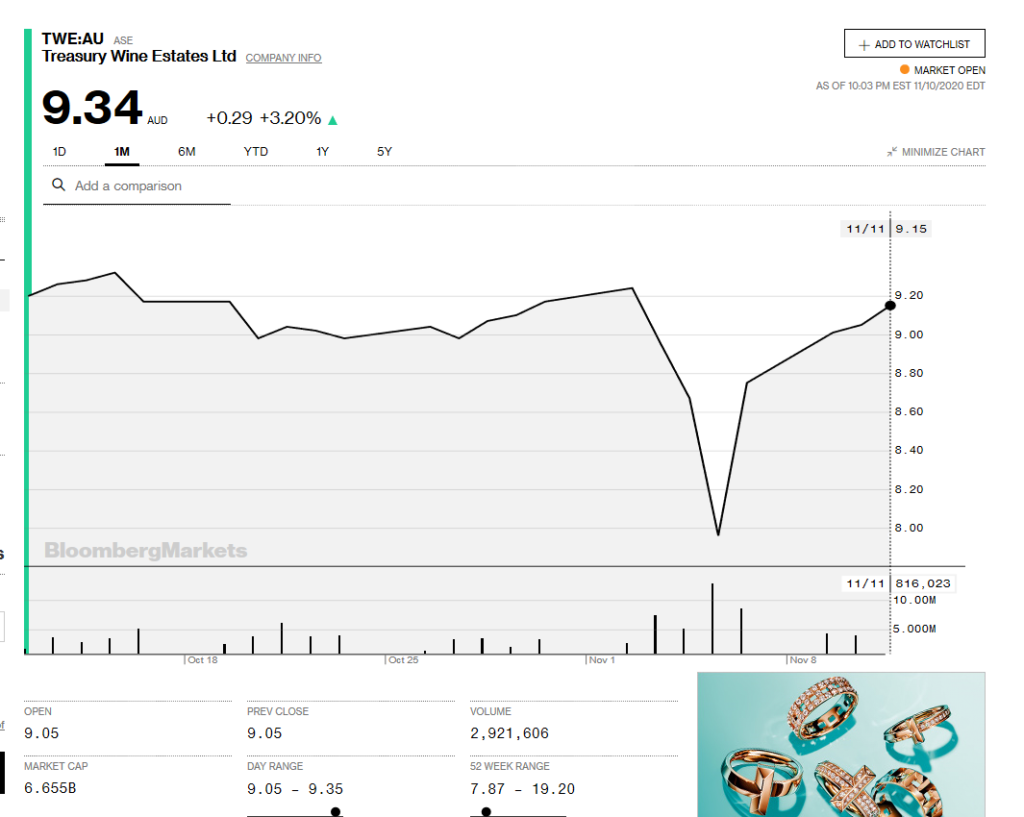

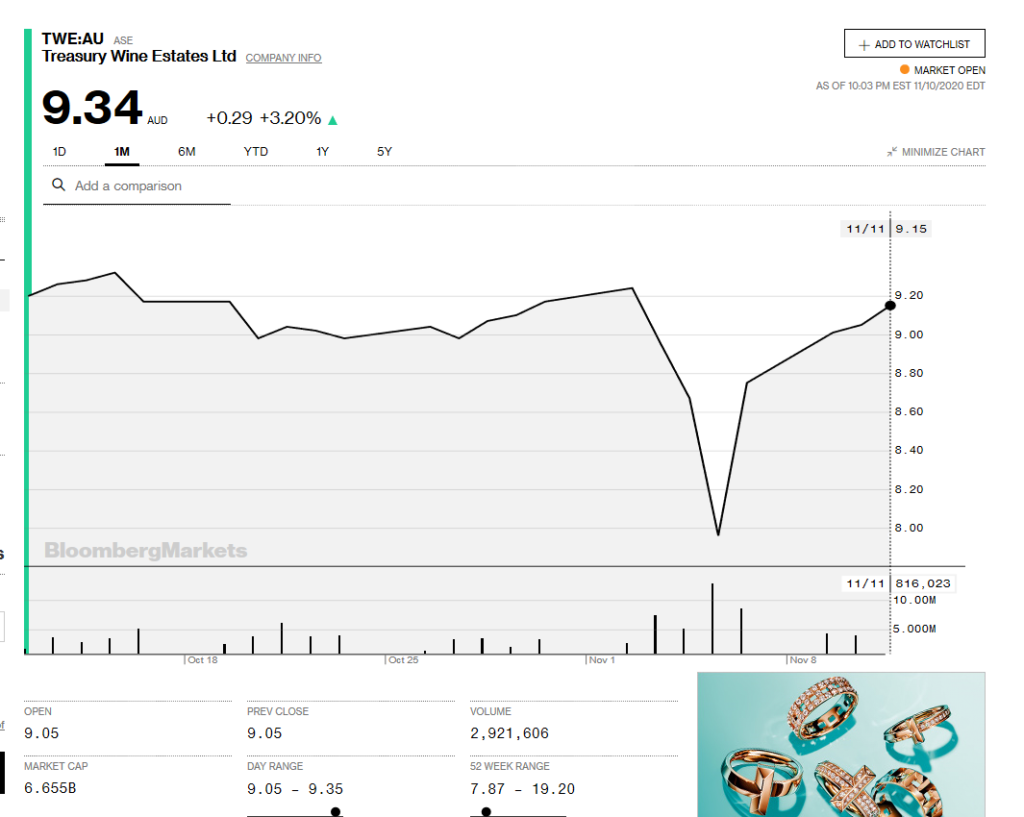

Shares in Australia’s largest wine producer, Treasury Wine Estates (TWE), have recovered slightly after falling to their lowest level since Janaury 2016 on a possible ban on wine exports to China, rising back over $9 from $7.87.

Sharp falls in the company fell last week after reports of possible tariffs being imposed on Australian wine exports to China or an outright ban. The company has also paused on a sale of the famous Penfolds brands to focus on China’s anti-wine dumping inquiry and boosting its wine operations.

Treasury said it is examining a range of measures including passing on the cost of tariffs to Chinese customers, reallocating wine to Europe and the US, and boosting investment in overseas vineyards such as in France, which would be exempt from potential tariffs on Australian wine exports.

TWE also said on 5 November that the potential demerger of its Penfolds business has been paused, with TWE now assessing an “internal operating model” to deliver long-term value.

“TWE is currently prioritising focus on trading performance, delivering structural changes in the US and responding to the China Ministry of Commerce investigation,” the company said in a trading update.

“We respect the process initiated by the Chinese government and we will continue to fully cooperate as these investigations continue.”

TWE’s share have been battered as a result of the tariff request, China’s anti-dumping announcement and the COVID-19 pandemic, falling to around $7.87 on November 5, their lowest level since January 2016, according to Bloomberg data, before recovering slightly to around $9.34 on November 11. This is dramatically down on their 52-week high of $19.20.

TWE said the China Alcoholic Drinks Association (CADA) has asked the Chinese Ministry of Commerce (MOFCOM) that imports of Australian bottled wine into China be subject to ‘retrospective tariffs’.

“TWE is also aware of recent media reports and speculation relating to a potential embargo on imports of Australian exports, including wine, into China. TWE has not had any advice or notification from the Chinese authorities in relation to this and is not in a position to comment on those reports at this point in time.”

Any tariffs on Australian wine would deal a big blow to an export market worth $1.2 billion, with China accounting for over one third of Australia’s wine exports by value. TWE said it was not in a position to provide an assessment of the financial impact of this development in fiscal year 2021.

Rumours of a wine ban follow threats from Chinese authorities to ban other Australian imports, including copper, coal and various agricultural exports including barley, sugar and lobster. Australia’s largest wine producer Treasury Wine Estates owns the heavily exported Penfolds and Lindemans brands.

On 28 September, MOFCOM announced it would conduct the anti-dumping investigation by using a sampling approach. MOFCOM selected TWE, Casella Wines and Australia Swan Vintage based on the companies’ reported export volumes. The companies had seven days to comment on “sampling results” from an initial investigations of their exports.

Separately, a Countervailing Duties Investigation has asked the same three companies, as well as Pernod Ricard, to comment on its initial sample results.

Australia is the biggest importer of wine into China, and TWE the biggest seller. Reflecting how lucrative Chinese consumers are, the average value of wine exported to China has jumped, as reported by World Wine Watch here.

Australian Prime Minister Scott Morrison has rejected any suggestion that Australian wine is subsidised or dumped in China, amidst fears it could dent exports.